What is Doji Candle Pattern: Disadvantages, Importance, Rules, Formation

Introduction

In the world of trading, candlestick patterns play a crucial role in technical analysis. Among these patterns, the doji candlestick stands out for its unique formation and significant implications. This article delves into the intricacies of doji candles, their importance, and how traders can effectively use them to make informed decisions.

Table of Contents

- What is a Doji?

- Why are Doji Candles Important?

- How to Use Doji to Place Trades

- Doji Candles in Determining Risk vs. Reward

- Disadvantages of Doji Patterns

- Determining a Winning Percentage

What is a Doji?

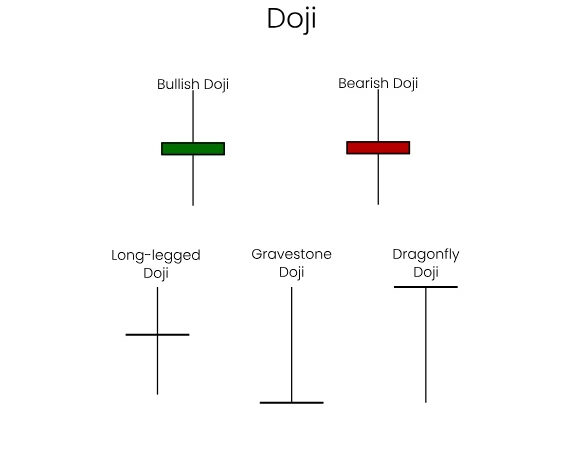

A Doji candlestick pattern forms when the open and close prices of a candlestick are equal or very close to equal. This formation suggests indecision between buyers and sellers. The appearance of a Doji can vary, with the length of the upper and lower shadows (wicks and tails) differing, giving the Doji the appearance of a plus sign, cross, or inverted cross. The Doji itself is considered a neutral pattern, with its bullish or bearish implications depending on the preceding price swing or trend.

Why are Doji Candles Important?

Doji candles are significant because they can either confirm or negate a potential significant high or low in the market. They often act as leading indicators, suggesting that a short-term price swing or trend reversal might be underway. Here are some key points about the importance of Doji candles:

- Confirmation of Highs/Lows: A completed Doji can help confirm or negate a potential significant high or low, indicating a possible reversal in the market trend.

- Indication of Indecision: Long-legged Doji patterns represent a significant amount of indecision, as neither buyers nor sellers can take control.

- Reversal Signals: Specific types of Doji, such as the Gravestone and Dragonfly Doji, provide insights into market sentiment. Gravestone Doji indicate that buyers initially pushed prices higher but sellers took control by the end of the session. Dragonfly Doji show the opposite, with sellers initially driving prices lower but buyers taking control by the end of the session.

- Strengthening Reversal Indicators: When found at support or resistance levels after a long trend or wide-ranging candlestick, Doji candles can strengthen other reversal indicators.

- Failed Doji: If a Doji pattern fails, it may suggest a continuation move rather than a reversal.

Example 1:

How to Use Doji to Place Trades

Doji candlesticks are neutral indicators that represent a tie between buyers and sellers. On their own, they do not provide a high probability trading signal. However, when used in conjunction with other forms of analysis, they can be valuable in confirming or negating significant highs or lows and helping traders determine whether a short-term trend is likely to reverse or continue.

Determining Support and Resistance

To use Doji candles effectively, it’s essential to identify support and resistance levels and the prevailing trend. The basic idea is to sell near resistance and buy near support. Here’s a step-by-step guide on using Doji with other technical indicators:

- Identify Support and Resistance: Determine support and resistance levels based on previously established highs and lows. Significant highs (peaks) and lows (valleys) help identify the beginning and ending points of price swings or trends.

- Use Fibonacci Retracements: Fibonacci retracement levels (38.2%, 50%, 61.8%, and 78.6%) can help identify potential support or resistance levels based on previous price swings or trends.

Example of Using Doji with Fibonacci Levels

Consider a Doji formation at the 78.6% Fibonacci retracement level of resistance. If a Doji occurs at this level, it may confirm the Fibonacci resistance and indicate a forthcoming reversal. Conversely, if the Doji fails and a new high is made above the Doji’s high, this would negate the reversal and suggest a continuation of the trend.

Placing Trades Based on Doji

When a Doji confirms a resistance or support level, a trader might:

- Enter a Sell Order: Place a sell order at the confirmed resistance level with a stop-loss order above the Doji and the Fibonacci level of resistance.

- Consider the Spread: Account for the spread in the market, which is the difference between the buy (ask) and sell (bid) prices.

- Set Profit Targets: Use the same Fibonacci analysis to set profit targets at support levels. Set profit targets just above Fibonacci levels to account for slight deviations.

Doji Candles in Determining Risk vs. Reward

The risk vs. reward ratio is a crucial aspect of trading. Here’s how Doji candles play a role in determining risk vs. reward:

- Risk Management: Calculate the risk based on the distance between the entry point and the stop-loss level. Ensure the risk is within your pre-determined maximum risk per trade.

- Reward Calculation: Set profit targets based on logical levels of support or resistance. The reward should justify the risk taken.

Example of Risk vs. Reward Calculation

Assume you enter a short trade after a Doji forms at a resistance level, with a stop-loss order placed above the Doji. If the potential profit target is just above the 38.2% Fibonacci retracement level, calculate the risk vs. reward ratio. If the ratio is acceptable, proceed with the trade, ensuring it fits within your risk management rules.

Disadvantages of Doji Patterns

While Doji patterns can be helpful, they also have disadvantages:

- Lack of Exit Signals: Doji patterns may help identify high probability market entries but do not indicate exit points.

- Dependence on Other Indicators: Doji candles need to be used in conjunction with other technical indicators to provide reliable trading signals.

- Neutral Nature: As neutral indicators, Doji patterns require additional confirmation before making trading decisions.

Determining a Winning Percentage

A trader’s winning percentage is crucial in assessing the effectiveness of a trading strategy. Here are key points to consider:

- Law of Large Numbers: The more trades placed, the closer you will come to the true probability of your trading strategy’s success. Trading is about probabilities, not certainties.

- Consistency: Maintain consistent trading rules and strategies to accurately determine your winning percentage.

- Risk vs. Reward: A high winning percentage combined with a favorable risk vs. reward ratio is essential for long-term profitability. A trader with a lower winning percentage can still be profitable if the risk vs. reward ratio is managed correctly.

In conclusion, Doji candles are valuable tools in technical analysis when used correctly. They provide insights into market indecision and potential reversals, but should always be used in conjunction with other technical indicators and sound risk management practices. By understanding the strengths and limitations of Doji patterns, traders can make more informed and profitable trading decisions.

A Doji forms when the open and close of a candlestick are equal, or very close to equal. It is considered a neutral formation suggesting indecision between buyers and sellers. The bullish or bearish bias depends on the previous price swing or trend. The length of the upper and lower shadows (wicks and tails) may vary, giving the appearance of a plus sign, cross, or inverted cross.

Why Are Doji Candles Important?

Completed doji candles may help confirm or negate a potential significant high or low. They may act as leading indicators suggesting a short-term price swing or trend reversal. Doji candles can also strengthen other reversal indicators, especially when found at support or resistance levels after a long trend or wide-ranging candlestick. Different types of doji candles, such as long-legged, gravestone, and dragonfly doji, represent varying degrees of market indecision and potential reversals.

How Do I Use Doji to Place Trades?

Doji are neutral indicators representing a “tie” in the battle between buyers (bulls) and sellers (bears). On their own, they do not provide high-probability trading signals. High-probability trades are identified through a convergence of signals, including trend and support & resistance levels. When used with other indicators, doji can help confirm significant highs or lows, aiding in determining short-term trend reversals or continuations.

To use doji in trading, first determine support & resistance and trend. The idea is to sell near resistance and buy near support. Trend direction helps decide market entry and exit points. Identify significant levels of support and resistance based on previously established highs and lows, and use Fibonacci retracements to pinpoint these levels.

Doji Candles in Determining Risk vs. Reward

Using doji candles to determine risk vs. reward involves setting logical profit targets and stop-loss levels based on support and resistance zones. Traders must manage emotions and stick to predefined plans. Even with a lower winning percentage, a favorable risk vs. reward ratio can lead to overall profitability. Successful trading relies on discipline, good risk management, and logical decision-making.

Disadvantages of Doji Patterns

While doji candles can help identify significant highs/lows and potential reversals, they do not provide exit points. High-probability trades require a favorable risk vs. reward ratio and a sufficient winning percentage. Identifying support & resistance levels and market trends is crucial. Traders should seek confirmation across multiple indicators and timeframes.

Determining a Winning Percentage

A small sample size of trades does not accurately reflect a winning percentage. The law of large numbers states that the more occurrences of a specific event, the closer you get to the true probability of that event recurring. Trading is about probabilities, not certainties, and consistency in following rules is essential for long-term success.

Follow Us on Our Social Media platforms.

All the information provided by us is only for educational purposes.

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiFOOG_wNueZLyqvw_z8_q6AvWZ8MDOCpR74x7_JMljYZiL0lCCpPWfPd4LojCrKBH-miuUO-fQHwF02IBbO0_7cHZjsE4pHP09n09cCn3v-HvOV8bV2Wu6EM5QOwQdZaa6X75OFlpO_aLfj5KJJ7slNyK6YP41fICVqmfc72CEejsO9eF1xkxgaURCQl7O/w620-h640/FXCA%20Doji%20Candles-svg.webp

2024-07-16 00:49:00