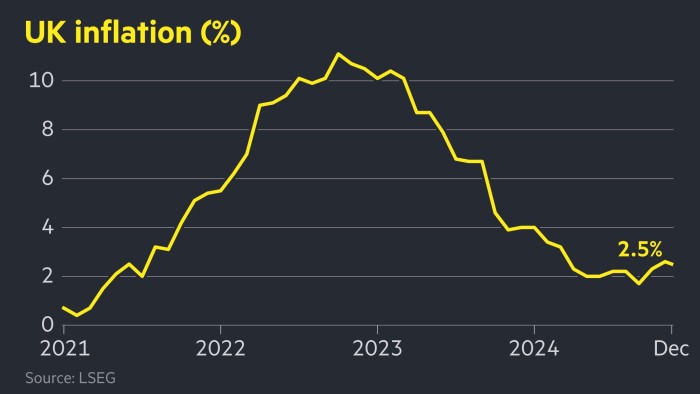

UK inflation unexpectedly slows to 2.5% in December

Stay informed with free updates

Simply sign up to the UK inflation myFT Digest — delivered directly to your inbox.

UK inflation unexpectedly slowed to 2.5 per cent in December, easing pressure on chancellor Rachel Reeves and clearing the path for the Bank of England to press ahead with cutting interest rates.

The consumer price index figure was below November’s 2.6 per cent reading, pulled lower by restaurant and hotel prices. Analysts had expected inflation to hold steady last month.

The data will provide some relief for Reeves, who is contending with higher borrowing costs fuelled by fears the UK economy could be entering a period of stagflation, in which sluggish growth is accompanied by persistent price pressures.

The recent increase in UK government borrowing costs, which last week hit a 16-year high, has threatened to blow a hole in the chancellor’s promise to balance day-to-day spending with tax receipts in 2029.

“There is still work to be done to help families across the country with the cost of living,” Reeves said on Wednesday, as she insisted she would “fight every day” to deliver growth and improve living standards.

Zara Nokes, an analyst at JPMorgan Asset Management, said: “After a difficult start to the year, this morning’s inflation print will provide some relief to chancellor Reeves.”

She added that a stronger inflation figure could have been “a catalyst for further volatility in the gilt market”.

The report from the Office for National Statistics comes as the BoE’s Monetary Policy Committee prepares to hold its first meeting of 2025 next month.

Following the data release, traders were pricing in a 75 per cent chance of a quarter-point cut in February, compared to about 60 per cent beforehand, according to levels implied by swaps markets.

Tomasz Wieladek, chief European economist at T Rowe Price, said the data was a “clear green light for another series of cuts”.

The BoE has estimated that the economy stagnated in the final quarter of 2024. Business surveys point to weaker confidence and hiring, which could curb inflationary pressures.

Wednesday’s data showed that services inflation, which is closely watched by the BoE as a gauge of underlying price pressures, slowed sharply to 4.4 per cent from 5 per cent previously.

It was also below the 4.9 per cent reading expected by economists.

Core inflation, which excludes food and energy, dropped to 3.2 per cent from 3.5 per cent.

The pound was down 0.2 per cent at $1.219 following the data release.

Lib Dem Treasury spokesperson Daisy Cooper said on Wednesday that the unexpected fall in inflation offered “a glimmer of hope but the reality is the UK economy remains stuck in the mud”.

Growth was “nowhere to be found”, she added, after the government’s “damaging” increase to employer national insurance.

Tory shadow chancellor Mel Stride welcomed the reduction, but warned there were “still challenges ahead”, with the employer national insurance rise “yet to bite” and likely to lead to higher prices.

Additional reporting by Ian Smith

https://www.ft.com/__origami/service/image/v2/images/raw/https%3A%2F%2Fd1e00ek4ebabms.cloudfront.net%2Fproduction%2F7cd84748-c63b-4f3c-8886-f7f6e71b8a71.jpg?source=next-article&fit=scale-down&quality=highest&width=700&dpr=1

2025-01-15 01:55:27