Crypto Market Suffers 10% Drop Amid $1.25 Billion Liquidations

Data from Coinglass revealed Bitcoin faced $45 million in liquidations, while Ethereum followed with $30 million. The market correction was triggered by the Federal Reserve’s latest rate cut of 25 basis points. While lower interest rates typically favor crypto, the Fed’s inflation forecasts and plans for only two rate cuts in 2025 caused a bearish reaction.

Stock markets experienced an even larger impact, with nearly $1.5 trillion wiped out. Analysts suggest the crypto sell-off may be a temporary shakeout. Philakone, a prominent analyst, noted that such liquidations often follow strong bullish runs, predicting recovery by mid-December.

Meanwhile, some experts anticipate a shift toward altcoins, as Bitcoin’s dominance could weaken. Ethereum and Solana may see gains if Bitcoin faces continued sell pressure.

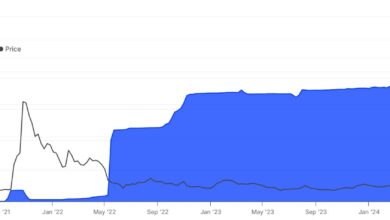

Despite the downturn, Bitcoin remains up 130% year-to-date, supported by major developments like MicroStrategy’s ongoing accumulation. The firm recently acquired $3 billion worth of Bitcoin, contributing to a tightening supply.

A CryptoQuant report highlights a potential Bitcoin supply shock. Rising demand, coupled with declining sell-side liquidity, suggests a bullish outlook. Stablecoin market growth and pro-crypto regulatory movements also add optimism.

While macroeconomic conditions drove today’s dip, long-term prospects for Bitcoin and the crypto market remain strong heading into 2025.

https://www.coinbackyard.com/wp-content/uploads/2024/12/1692425180622.jpeg

2024-12-20 02:47:28