Bitcoin Price Prediction 2025: Technical Analysis and Geopolitical Impacts on BTC USD

.cwp-coin-chart svg path

stroke-width: 0.65 !important;

Price

Volume in 24h

<!–

?

–>

Price 7d

Bitcoin price in 2025 is shaped by technical trends and global dynamics. This article offers a Bitcoin price prediction 2025, combining BTC USD chart analysis with geopolitical impacts on Bitcoin price analysis. From critical support levels to regulatory shifts, we explore how technical analysis of Bitcoin and geopolitical effects on BTC influence its trajectory, providing a clear BTC price forecast for 2025.

Strategy has acquired 6,911 BTC for ~$584.1 million at ~$84,529 per bitcoin and has achieved BTC Yield of 7.7% YTD 2025. As of 3/23/2025, we hodl 506,137 $BTC acquired for ~$33.7 billion at ~$66,608 per bitcoin. $MSTR $STRKhttps://t.co/oM30PS9yqa

— Strategy (@Strategy) March 24, 2025

A week after Jerome Powell’s long-awaited March FOMC meeting, crypto markets are stable and pushing to the upside in light of positive news surrounding the Ukraine Peace Talks in Saudi Arabia. Please visit my previous Bitcoin article for additional context here

DISCOVER: Top Solana Meme Coins to Buy in March 2025

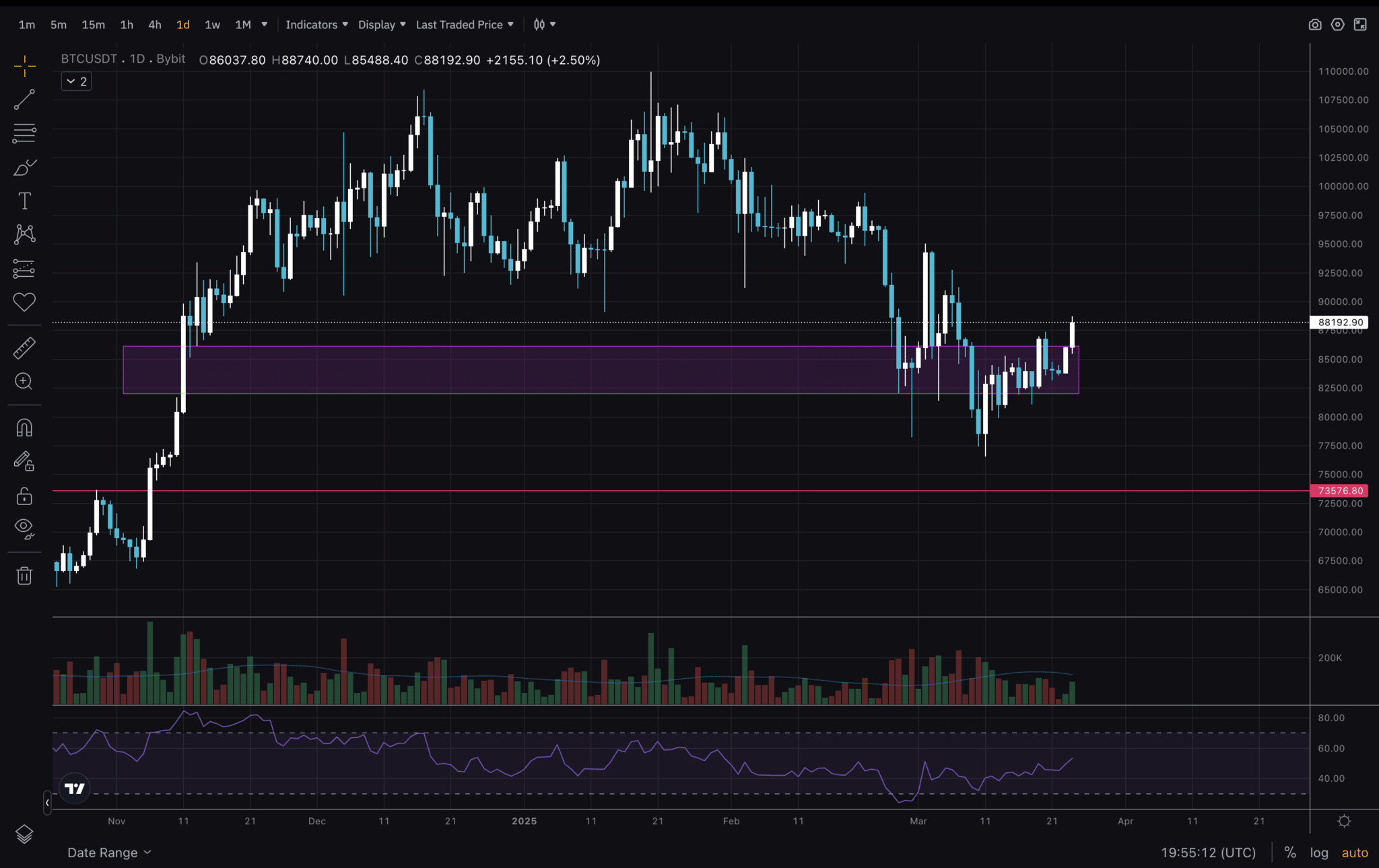

Bitcoin Price Analysis 2025: BTC Price Daily Chart Insights

A break below could target $70,000, a major psychological level, while a bounce could push BTC to $94,000. The BTC price forecast 2025 hinges on this support, as Bitcoin chart analysis suggests consolidation. Geopolitical factors, like U.S. pro-crypto policies, could further influence this Bitcoin price outlook 2025.

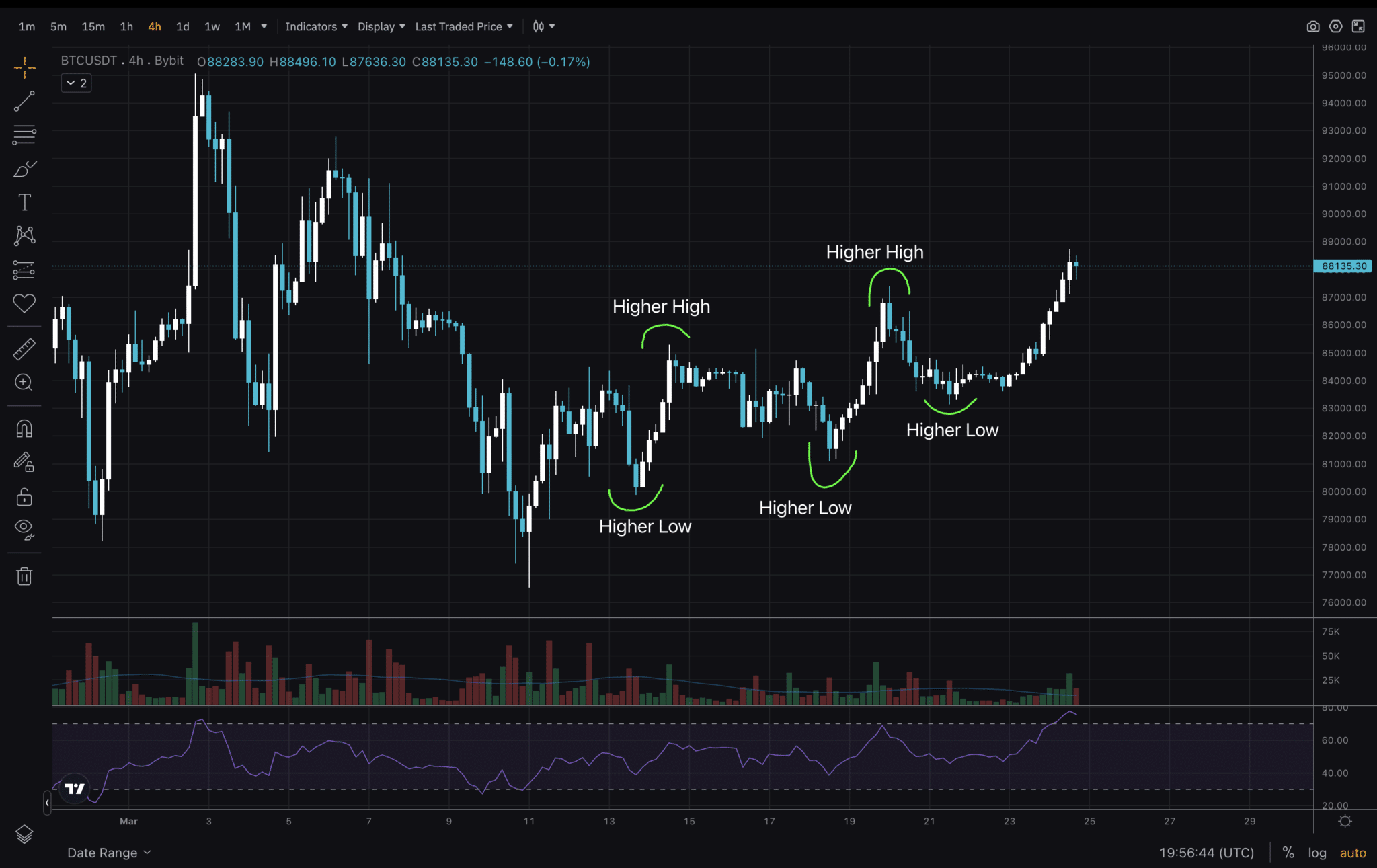

Bitcoin Price Analysis 2025: BTC/USD – 4H Timeframe

(BTCUSDT)

Bitcoin Price Analysis 2025: BTC USD Short-Term Outlook Conclusion

Bitcoin Price Prediction 2025: Technical Analysis and Geopolitical Impacts on BTC USD

- Critical Support Level: Bitcoin’s price at $87,000 is a pivotal support; holding this could lead to a rally toward $94,000, while a break below may target $70,000

- Geopolitical Influence: Pro-crypto U.S. policies and global economic uncertainty could drive Bitcoin’s price, with potential to reach $120,000 by year-end if conditions remain favorable.

- Technical Trends: The 4H chart shows a downtrend with reversal signals, while the 1D chart suggests consolidation, highlighting short-term volatility and long-term bullish potential.

The post Bitcoin Price Prediction 2025: Technical Analysis and Geopolitical Impacts on BTC USD appeared first on 99Bitcoins.

[og_img]

2025-03-24 13:01:47