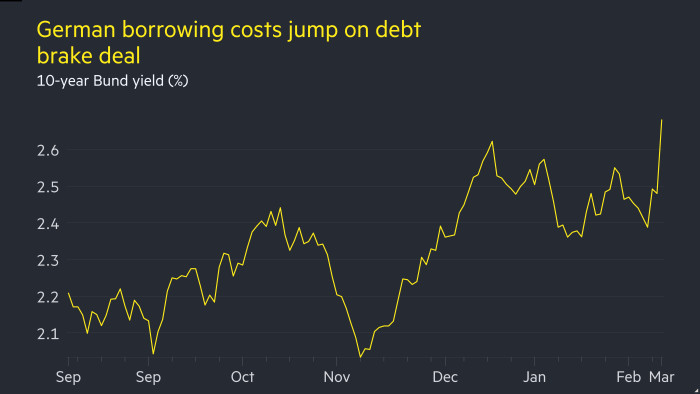

German borrowing costs soar after Merz deal to boost military and infrastructure spending

Stay informed with free updates

Simply sign up to the German economy myFT Digest — delivered directly to your inbox.

German borrowing costs surged on Wednesday after chancellor-in-waiting Friedrich Merz agreed a historic deal with his probable coalition partners that would relax the country’s strict “debt brake” rules to fund investment in the military and infrastructure.

The yield on the 10-year Bund surged 0.19 percentage points to 2.67 per cent, its biggest one-day move since 2020, as investors braced for extra borrowing from the government and a boost to Germany’s economic growth.

Merz said late on Tuesday that his party and the rival Social Democrats (SPD) would jointly present a bill next week to relax the country’s strict borrowing rules.

Deutsche Bank economists described the deal as “one of the most historic paradigm shifts in German postwar history”, adding that both the “speed at which this is happening and the magnitude of the prospective fiscal expansion is reminiscent of German reunification”.

Germany’s largest bank said that it was likely to lift its forecast for the country’s GDP “once there is more clarity in the coming days”, adding that “there is now meaningful upside risk to our 1.0 per cent growth forecast for 2026”.

The deal struck by Merz and the SPD, his likely coalition partner, would exempt defence spending above 1 per cent of GDP from Germany’s strict constitutional borrowing limit, set up a €500bn off-balance sheet vehicle for debt-funded infrastructure investment and loosen debt rules for states.

The euro rose 0.8 per cent against the dollar to $1.071, its highest since November, and German stocks surged as investors bet on a boost to the economy.

Merz is planning to push the changes through parliament this month, making use of the outgoing parliament’s majorities. Far-right and far-left parties won a blocking minority in the February 23 election and could prevent any constitutional change in the next legislative period.

The deal between Merz CDU/CSU party group and the SPD still requires the support of the Green party to get to the two-thirds majority to change the constitution. The Greens have long called for debt brake reform but senior party figures said that they first needed to digest the details of the plan before taking a view. Analysts expect the party to ultimately acquiesce.

Cyrus de la Rubia, chief economist of Hamburg Commercial Bank, said the fiscal plan would quickly boost economic sentiment and growth as “companies and citizens will feel that something is finally being done”.

Economists had previously predicted another year of economic stagnation or decline for 2025, after Germany’s GDP shrank for two consecutive years as it grappled with high energy costs, weak corporate investment and feeble consumer demand.

“This fiscal sea change will permanently alter the way that Bunds are trading,” said Tomasz Wieladek, chief European economist at asset manager T Rowe Price.

Investors regard Germany’s debt as the benchmark risk-free asset for the entire Eurozone but its bonds have historically been in short supply because of its reluctance to borrow heavily.

France’s 10-year government bond yields were dragged higher, with the yield up 0.12 percentage points to 3.35 per cent.

Germany’s Dax index, which had tumbled on Tuesday after the US imposed tariffs on some trading partners, surged 2.7 per cent.

German infrastructure companies were among the biggest gainers, with Heidelberg Materials up 11 per cent, while Bilfinger rose 17 per cent. Thyssenkrupp, Germany’s largest steelmaker, gained 15 per cent.

Europe’s defence sector extended a blistering rally. Shares in Rheinmetall, Germany’s largest defence company, were up 6.2 per cent while Paris-listed Thales rose 6.8 per cent.

The gains spread to other European markets, with the continent-wide Stoxx Europe 600 up 1.1 per cent.

Asian stock markets earlier rebounded after comments from US commerce secretary Howard Lutnick that implied tariffs could be lowered on America’s neighbours.

Futures contracts tracking the US S&P 500 index were up 0.6 per cent. The dollar slipped 0.4 per cent against a basket of six currencies including the euro and pound.

Lutnick’s comments came after US President Donald Trump on Tuesday hit imports from Canada and Mexico with 25 per cent tariffs and imposed an additional 10 per cent tariff on Chinese imports, on top of a 10 per cent levy set last month.

In his first major policy address to Congress, Trump said tariffs would cause “a little disturbance”.

https://www.ft.com/__origami/service/image/v2/images/raw/https%3A%2F%2Fd1e00ek4ebabms.cloudfront.net%2Fproduction%2F6364d13c-794f-47d6-bb41-0d09b77c99b7.png?source=next-article&fit=scale-down&quality=highest&width=700&dpr=1

2025-03-05 03:48:32