2 High-Growth Electric Vehicle (EV) Stocks to Buy Now (Hint: Not Tesla)

Tesla (NASDAQ: TSLA) has been one of the best investments of all time. Since 2010, shares have increased in value by more than 19,000%. Even a small initial investment could have turned into a fortune for investors who held on throughout the volatility.

With a market cap of nearly $800 billion, Tesla’s biggest days of growth are arguably behind it. This reality has caused investors to search for the next Tesla capable of producing huge gains. If you’re also on the lookout for the next Tesla, the two electric vehicle (EV) stocks below should top your watchlist.

This year, my top pick among EV stocks is Rivian (NASDAQ: RIVN). When you compare Rivian’s growth prospects with its valuation, the risk-reward trade-off looks very appealing. But there’s a catch.

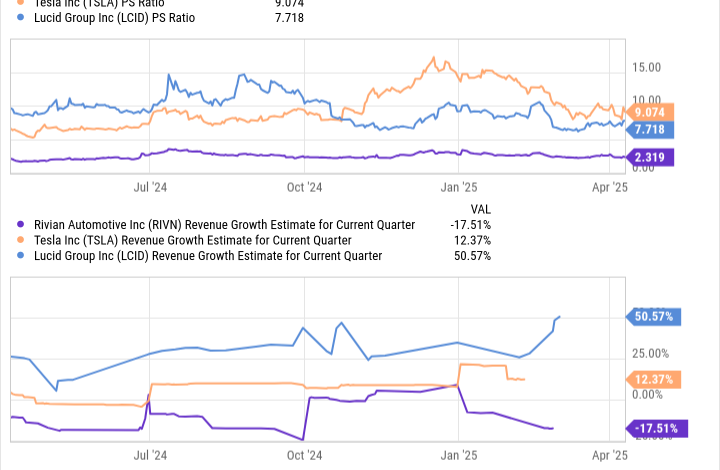

With only two high-end luxury models in its lineup — the R1T and R1S, both of which can cost upwards of $100,000 with certain options — Rivian’s total addressable market is fairly limited. Most car buyers simply can’t afford its vehicles. And since both vehicles have been on the market for a number of years, most early adopters already own one. This has caused Rivian’s sales growth to plateau. Next quarter, analysts expect sales to decrease by around 17.5%. The competition, meanwhile, is expected to grow sales next quarter by double-digit rates.

Fortunately, Rivian stock is appropriately priced for this reality. At 2.3 times sales, Rivian trades at a sizable discount to the competition. Yet, in 2026, sales growth should pick up considerably with the launch of three mass market models, all of which should be priced under $50,000, dramatically increasing Rivian’s potential sales base.

This is the catch with Rivian stock right now. Shares are undeniably cheap, but near term results are expected to be very poor. But if you’re willing to look past 2025, Rivian’s prospects should improve considerably. Expect plenty of volatility, but Rivian’s valuation today is almost too good to pass up, as long as you’re willing to commit to a holding period of several years.

Want even bigger growth potential than Rivian? Check out Lucid Group (NASDAQ: LCID). There’s more risk to this story, but the greater upside arguably makes up for that fact.

Lucid has a significantly higher valuation than Rivian, with shares trading at 7.7 times sales. But its near-term growth expectations are also significantly higher. This quarter, revenue is expected to jump by more than 50%. That’s largely the result of its new Gravity SUV platform being shipped to new customers. This is Lucid’s second major model introduction, with the potential to more than double sales over time.

https://media.zenfs.com/en/motleyfool.com/d5c890c92a1623f77c3beabbd337d82e

2025-04-14 07:05:00