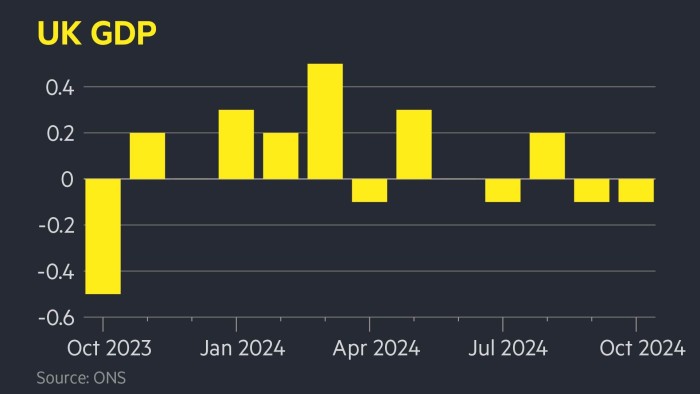

Chancellor Rachel Reeves’ mission to boost Britain’s growth rate ran into trouble on Friday, as the UK economy unexpectedly shrank 0.1 per cent in October, the second consecutive contraction.

The Conservatives accused Reeves of talking down the economy and of spooking business with the threat of tax rises, while the chancellor admitted the latest data was “disappointing”.

The monthly GDP change, published by the Office for National Statistics, undershot the 0.1 per cent expansion forecast by economists polled by Reuters. It followed a 0.1 per cent contraction in the previous month.

The data suggests the economy shrank even before Reeves’ £40bn tax-raising Budget on October 30.

Although business was braced for higher taxes, many companies said the chancellor’s £25bn hike in employers’ national insurance will hit hiring and could lead to higher prices.

The run-up to the Budget was shrouded in gloomy political rhetoric by Reeves and it appeared to dampen consumer and business confidence. The chancellor claimed the Tories had left her “with the worst inheritance since the second world war”.

Sterling was down 0.4 per cent against the dollar at $1.262. The yield on the two-year gilt, which moves inversely to prices, was up 0.01 percentage points at 4.29 per cent.

The figures underscore the economic challenge for the new Labour government, which won the UK general election in July with a manifesto commitment to “secure the highest sustained growth in the G7”.

If growth continues to undershoot expectations it could also throw into doubt Reeves’ fiscal calculations and her promise to business leaders this month that she was not “coming back with more borrowing or more taxes”.

The Office for Budget Responsibility said in October that Reeves had left herself “headroom” of just £9.9bn against her pledge to balance the current budget by 2029-30.

Reeves’ allies insisted the chancellor had been forced to take tough decisions in her Budget and that long-term reforms in areas such as pension and planning would underpin stronger growth.

“While the figures this month are disappointing, we have put in place policies to deliver long-term economic growth,” Reeves said on Friday.

The Conservatives claimed the poor growth figures reflected the impact on business of Reeves’ gloomy post-election rhetoric on the economy.

Mel Stride, shadow chancellor, said on Friday: “It is no wonder businesses are sounding the alarm. This fall in growth shows the stark impact of the chancellor’s decisions and continually talking down the economy.”

Friday’s figures point to a weak start to the fourth quarter after annual economic growth slowed to 0.1 per cent in the three months to September, down from 0.5 per cent in the previous quarter.

Paul Dales, chief UK economist at Capital Economics, noted that the economy had grown in just one of the five months to October, and that output was now 0.1 per cent lower than before Labour came into power.

“That suggests it’s not just the Budget that is holding the economy back,” he said. “Instead, the drag from higher interest rates may be lasting longer than we thought.”

Capital Economics downgraded its 2025 growth forecast from 1.6 per cent to 1.4 per cent after Friday’s data release.

Last week the OECD cut its 2024 growth forecast for the UK to 0.9 per cent from the 1.1 per cent that was expected in September due to weaker incoming data.

However, it expects growth to accelerate to 1.7 per cent in 2025. That figure is weaker than the 2.4 per cent expansion forecast for the US, but stronger than the 1.3 per cent for the Eurozone.

According to Friday’s ONS figures, output in the dominant services sector registered no growth in October, with production contracting 0.6 per cent and construction registering a 0.4 per cent fall.

“The risk of a quarterly contraction [in the final three months of the year] is no longer negligible,” said Sanjay Raja, economist at Deutsche Bank, noting that a possible trade war when President-elect Donald Trump re-enters the White House represented a significant external headwind.

ONS director of economic statistics Liz McKeown said: “Oil and gas extraction, pubs and restaurants and retail all had weak months, partially offset by growth in telecoms, logistics and legal firms.”

Separate data published on Friday by research company GfK showed consumer confidence remained low in November, edging up only one point to minus 17 in December.

The ONS reported mixed comments from businesses relating to the Budget. Those negatively affected said turnover was hit as customers waited for announcements from the chancellor.

However, others said activity had been brought forward in anticipation of various Budget measures.

UK Prime Minister Sir Keir Starmer recently announced he would target household disposable income as a new “milestone” for rating the success of his economic policies.

High borrowing costs are still limiting household spending and business activity, but they have come down from their peak after the Bank of England cut interest rates in August and November to the current 4.75 per cent.

Traders expect three quarter-point rate cuts next year as inflation eases from its multi-decade high reached in 2022.

“With more and more companies stating they will cut back on hiring and investment to deal with the rising costs related to the Budget, the question will be, where will growth actually come from?” asked Isaac Stell, Investment Manager at Wealth Club.

However, James Smith, economist at ING, said he believed the UK economy was still “poised to outpace most of western Europe next year” since Labour increased public spending by more than 2 per cent of GDP compared with the Conservatives’ Budget plans.

Additional reporting by Jim Pickard

https://www.ft.com/__origami/service/image/v2/images/raw/https%3A%2F%2Fd1e00ek4ebabms.cloudfront.net%2Fproduction%2F94162c92-5dd3-46e4-8c25-a9efd09083ef.jpg?source=next-article&fit=scale-down&quality=highest&width=700&dpr=1

2024-12-13 09:49:32