Key Takeaways

- The SEC is facing its first deadline to decide on Grayscale’s proposal to convert Solana Trust to an ETF.

- Multiple firms, including VanEck and Bitwise, await SEC decisions on their Solana ETF proposals.

Share this article

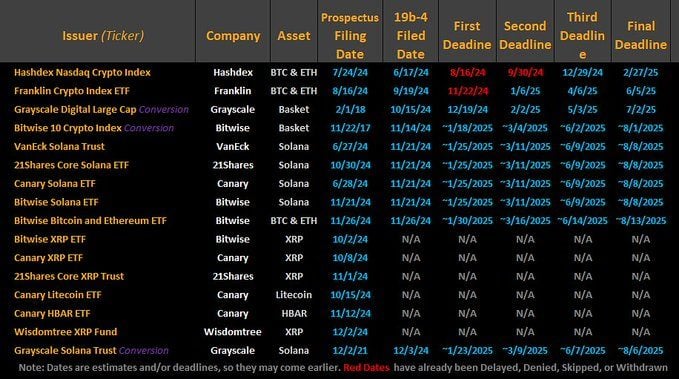

The US SEC faces its first deadline today to make a decision on Grayscale’s application to convert its Solana Trust (GSOL) to an ETF. Proposed Solana ETFs from VanEck, 21Shares, Canary Capital, and Bitwise expect the regulator’s decision on Jan. 25.

NYSE Arca proposed listing shares of GSOL as a spot Solana ETP on December 4. The trust, which launched in April 2023, had 7,221,835 outstanding shares as of January 21.

The deadline comes after Gary Gensler’s departure as SEC Chair. Under Gensler, the SEC’s Division of Enforcement initiated numerous lawsuits against crypto companies, including ones targeting Binance and Coinbase, where the regulator classified Solana and a number of other digital assets as securities.

According to Bloomberg ETF analyst James Seyffart, the Enforcement Division’s stance makes it challenging for other SEC divisions to consider a commodities ETF for Solana.

“The timeline could extend into 2026 due to the SEC’s precedent of taking,” Seyffart said in a recent interview with Blockworks Macro. “The SEC’s Division of Enforcement is calling Solana a security, which prevents other SEC divisions from analyzing it for a commodities ETF wrapper.”

For Solana ETFs to be approved, regulatory hurdles need to be resolved. ETF analysts suggest that the appointment of crypto advocate Paul Atkins to chair the SEC could facilitate this change.

However, Atkins’ confirmation process is expected to take several months. The SEC currently operates with three commissioners, including Mark Uyeda, who has been designated as Acting Chair following the recent transition of leadership under President Trump, Hester Peirce, and Caroline Crenshaw.

According to Sol Strategies CEO Leah Wald, while a change in SEC leadership could potentially shift the regulatory landscape—with some speculating that Paul Atkins (if confirmed) could positively influence future decisions on Solana ETF filings—an immediate greenlight is unlikely.

“I think there’s quite a while until a SOL ETF gets approved,” she said in an earlier statement, adding that it could take a year or more for regulators to understand Solana’s unique attributes.

Last July, VanEck and 21Shares filed the 19b-4 forms with the SEC for their respective Solana ETFs, starting the regulatory review process. Canary Capital and Bitwise joined the race later that year.

According to Matthew Sigel, Head of Digital Assets Research at VanEck, Solana functions similarly to other digital commodities like Bitcoin and Ethereum.

Solana and XRP are considered the leading candidates for the next wave of spot crypto ETFs, but due to ongoing legal challenges, ETF analysts suggest an ETF tied to Litecoin is “most likely” the first to launch under the Trump administration.

The CFTC views Litecoin as a commodity in its case against KuCoin.

Share this article

https://static.cryptobriefing.com/wp-content/uploads/2025/01/23033338/02b645e3-8ccb-4828-b3c1-b900d6a52278-800×420.jpg

2025-01-23 02:42:39