Currently yielding 5.1%, purchased shares of UPS (NYSE: UPS) would generate $6,550 in annual income if you invested $100k across both stocks. While there are question markets around the business and its full-year guidance, the stock still represents an excellent value for long-term investors. Here’s why.

A blue chip stock like UPS yields 5.1% for a reason, and that comes down to some market skepticism over the company’s dividend and/or its ability to grow its dividend. That’s understandable. After all, management’s stated aim is to pay about 50% of its adjusted earnings per share (EPS) in dividends. Unfortunately, with the market expecting just $7.49 in EPS this year, the current dividend of $6.52 is equivalent to 87% of its EPS.

Analysts asked management about the sustainability of the dividend on an earnings call earlier in the year, and CEO Carol Tome insisted, “We have no intent to cut the dividend just to make that math work.” In other words, the dividend won’t be cut so that UPS can meet its aim of paying a dividend equivalent to 50% of earnings. Instead, management plans to increase its earnings to get the ratio back to 50%.

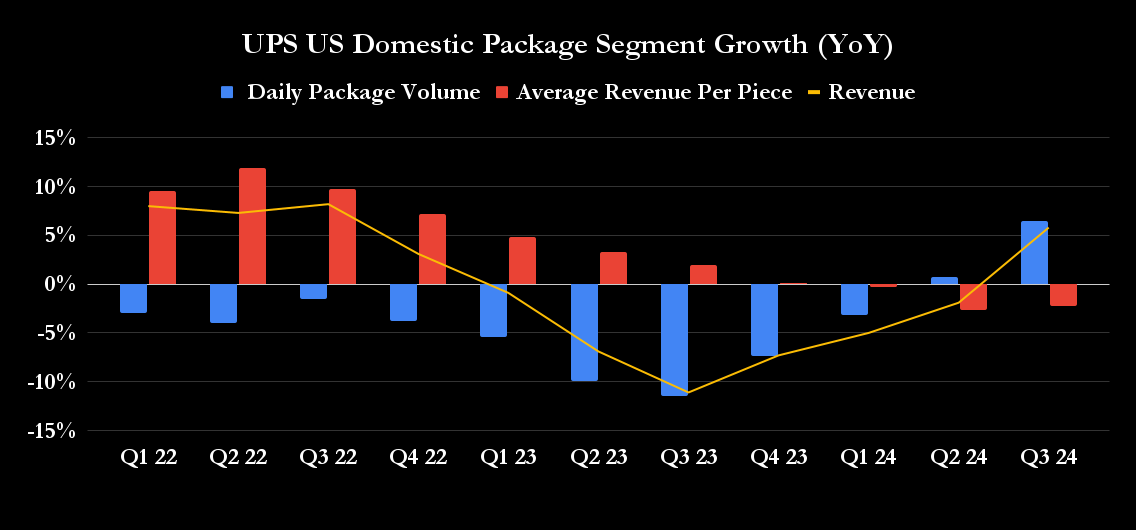

Fortunately, there is good reason to believe it can. After a couple of years of declining package volumes in its core U.S. domestic market, UPS is improving its volumes again, and its revenue is growing.

At the same time, the company is now lapping the increase in labor costs associated with a new contract agreed upon at the end of a protracted negotiation last year, making easier cost comparisons in the future. Moreover, UPS made good progress on costs in its domestic segment in the third quarter when reporting a 4.1% year-over-year decrease in cost per piece, which more than offset the 2.2% decline in revenue per piece , resulting in margin expansion.

Furthermore, UPS will reduce printing costs by $1 billion by cutting 12,000 jobs in 2024 as it reduces capacity to adjust to market demand.

As outlined in the Investor Day presentation in March, the U.S. small-package market moved from a capacity shortfall of an average daily volume of 6 million packages during the lockdown period to a capacity surplus of an average daily volume of 12 million packages in 2023/2024.

The overcapacity is due to an unexpected shortfall in delivery volumes due to persistently high interest rates slowing economic activity (there’s also the issue of customers shifting to lower-cost delivery options) and a spillover from the capacity increase made by the industry to deal with the capacity shortfall during the lockdowns.

Still, volumes are improving, and lower interest rates in 2025 are likely to boost economic activity and, in turn, package deliveries.

While the growth in lower-revenue-per-piece deliveries is far from ideal for UPS, it’s the reality of the marketplace now, and UPS is muddling through a difficult period. That said, management is continuing its long-term and highly successful strategy of focusing on growth in small and medium-sized businesses (SMBs) and healthcare.

For example, the Investor Day plans call for UPS to double its healthcare-related revenue from $10 billion in 2023 to $20 billion by 2026. Similarly, management intends to take its penetration of the U.S. SMB market from 29% in 2023 to 40% over the long term.

Meanwhile, UPS continues to invest in creating the “network of the future” by investing in automation and smart facilities; these investments should improve productivity, allowing UPS to cut costs by consolidating locations.

Given the challenges this year, UPS might not meet its full-year guidance, but trading on the current valuation, it’s hard not to think the market is already expressing that view in the share price. As such, the stock could have a considerable upside if it meets guidance.

Thinking longer-term, all the elements are in play for a multiyear company recovery, which could mean excellent long-term returns for investors. The improving outlook makes it more likely that UPS will sustain its dividend and look to grow earnings to decrease the payout ratio. All told, the stock looks like a superb value.

Before you buy stock in United Parcel Service, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and United Parcel Service wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $825,513!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 16, 2024

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool recommends United Parcel Service. The Motley Fool has a disclosure policy.

1 High-Yield Dividend Stock You Can Buy and Hold for a Decade was originally published by The Motley Fool

https://media.zenfs.com/en/motleyfool.com/a1fcef1bd0b114d5cb4f1553bbc5e9cf

2024-12-23 03:06:00